In the budgeting world, you won’t go far without hearing about Dave Ramsey’s EveryDollar. Being a long-time You Need a Budget (YNAB) user, I was curious to see how EveryDollar stacked up. Especially since EveryDollar has a free option.

Would EveryDollar be good enough to switch away from YNAB? Or at least worth recommending to friends who don’t want to pay for YNAB?

I used YNAB and EveryDollar side-by-side for an entire month and focused on three areas I believe are important for any app wanting to help people get their money under control.

How easy is it to:

- Create your first month’s budget?

- Add transactions from your smartphone?

- Balance your budget at the end of the month?

This post shares what I learned and crowns a winner!

Note: Because YNAB is a subscription service, I’ll be comparing YNAB to EveryDollar’s subscription service (called Ramsey+) with a separate section for the free version.

Test drive YNAB free for 34 day. And #protip, you can email support requesting extra time if that’s not long enough. They’re typically very generous honoring those requests!

Note: If you sign up for a free trial using links in this post, I’ll get a small commission. And please know I wrote this review before I knew I could earn a commission. It’s genuinely my honest, unbiased experience using both apps.

Creating Your First Budget

EveryDollar

Creating a budget is a simple process in EveryDollar.

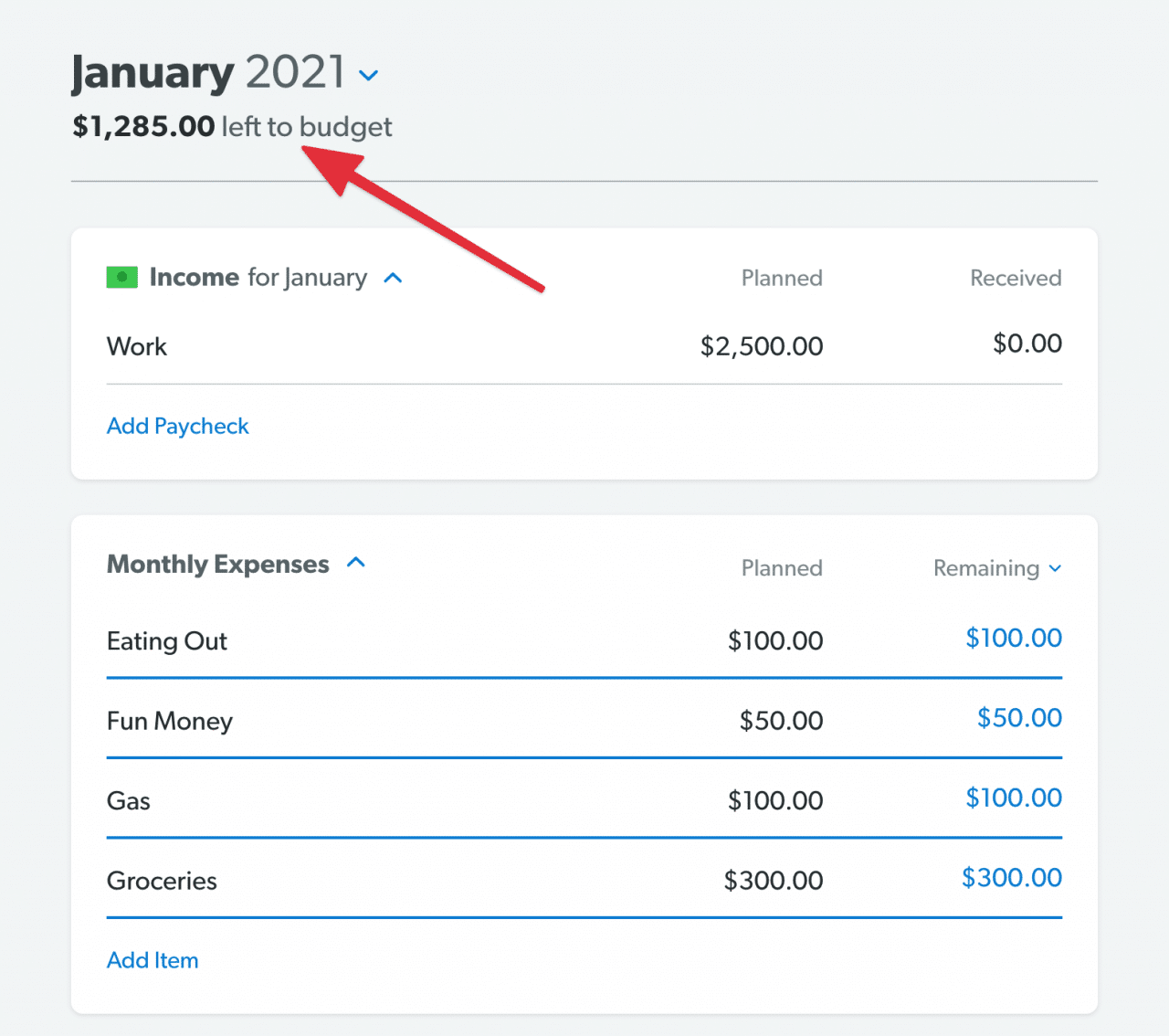

Once you create an account and log in, you’ll immediately be taken through a step-by-step guide that walks you through budgeting some of the more common categories. Afterward, you can further refine your budget to get the “left to budget” amount to zero.

You Need a Budget

Once you log into YNAB for the first time, you’re greeted with a getting started tutorial that’s definitely worth going through. It’ll walk you through adding your accounts (checking, saving, credit card, etc.) and their starting balances.

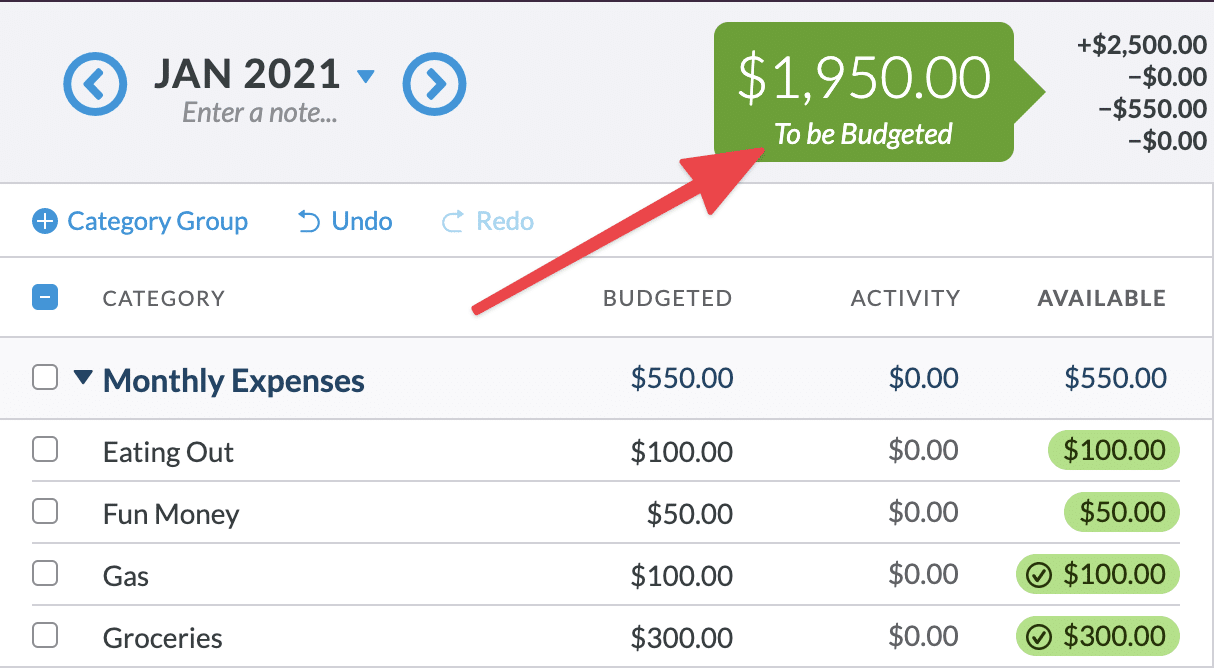

Similar to EveryDollar, you’ll then distribute your money into the different categories until the “to be budgeted” amount reaches zero.

The big difference here is that instead of budgeting a single month based off your expected monthly income (like EveryDollar), your first budget is based off how much money you have combined across your checking and savings accounts. This is because YNAB encourages budgeting using only money that’s actually in the bank (versus forecasting future income).

Winner: EveryDollar

There’s no question here. EveryDollar is definitely a lot easier and quicker to get started with. When you get in the “cockpit” of EveryDollar, it’ll feel familiar. Like most other budgeting apps out there.

However, getting into the cockpit of YNAB can feel a tad overwhelming. While YNAB’s approach to budgeting, handling of credit cards, and other features (like goals and reconciling) are extremely helpful, there is a learning curve to fully understand how and why they’re useful.

Adding Transactions

The best way to keep track of your budget is to add each transaction as they happen. That means the mobile apps for EveryDollar and YNAB are critical pieces to budgeting success.

The focus of this section will be on adding transactions on the iPhone.

EveryDollar (2020.11.30)

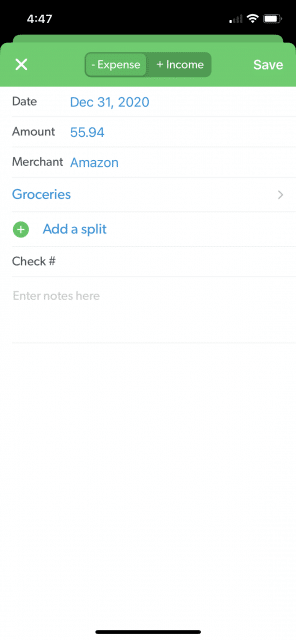

Just like creating your first budget, EveryDollar’s iPhone app makes it straightforward to add a new transaction.

Nothing fancy here.

Type in an amount, type in the merchant name, and choose a budget category. After entering a transaction, you can scroll to the category to see how much money is left (making sure you’ve toggled the Remaining view).

You Need a Budget (2.14.1)

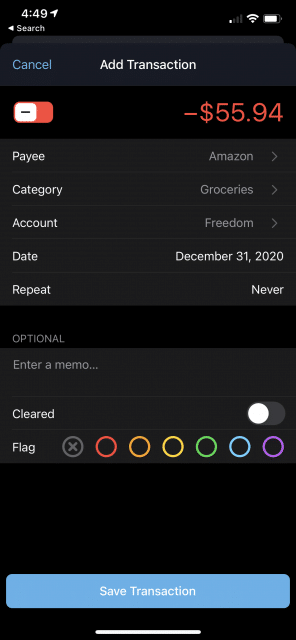

Let me just go on the record here and say YNAB’s iPhone app is gorgeous. It’s obvious from the start a lot of care went into designing YNAB (and how you use it).

You’ll type in the same things as you would in EveryDollar.

However, the strength of YNAB becomes more apparent when you re-visit a place you’ve already shopped.

More details later when I declare a winner for this section.

Winner: YNAB

There’s two noteworthy features YNAB has that EveryDollar doesn’t.

- YNAB uses GPS to remember all the places you shop at.

- YNAB uses default values whenever it can.

Both those things drastically speed up how quickly you can add a transaction.

The easier it is to use an app, the more likely you will be to use it. When it comes to staying on budget every month, this becomes an important point.

The second time you visit a store, YNAB will either pre-populate the payee with the store based on your location or show you a dropdown of nearby stores. YNAB will also default the category to the last one used for selected payee.

All this makes adding future transactions from previously visited spots a quick process.

On the flip side, EveryDollar makes you manually type out the store name (made somewhat quicker by predictive text) and choose a budget category every time you make a purchase.

Balancing Your Budget

I won’t get into a rant here, but if you don’t do this step regularly (at least once a month) then you’re not really budgeting. You’re just tracking your spending.

What does balancing your budget mean?

It means every budget category is at $0 or has a positive dollar amount before moving on to the next month’s budget.

If you overspend by $50 in groceries this month, you take $50 from a different budget category (one that has an extra $50 to spare) and move it into the groceries category to compensate for the overspending.

It could also mean “sweeping” all your surplus (money you budgeted but didn’t spend) into a specific saving goal or into more important categories.

Balancing your budget requires two things:

- An easy way to move money from one category to another.

- Confidence you’ve recorded every transaction for the month.

Now let’s take a look at how EveryDollar and YNAB stack up.

EveryDollar

Moving Money

It only took EveryDollar a few years, but they finally implemented an easy way to move money between categories. (Unfortunately, this is in the subscription version only. This feature is removed in the free version. 😠)

Reconciling Transactions

How about ensuring all my transactions have been added properly?

This was a nightmare.

I have a bunch of recurring transactions (rent, bills, subscription services, etc.) that happen without me physically paying for them (which is generally my reminder to add a transaction into my budgeting app). With EveryDollar, all of those have to be manually added every month because EveryDollar doesn’t support automatically adding recurring transactions.

And I don’t always remember to add transactions on my phone whenever they happen. So how do I know which transactions I forgot?

Lots of manual labor.

I had to look at statements from each bank account and check line-for-line if I entered the transaction into EveryDollar. And use a separate interim spreadsheet to track what transactions were in one spot (EveryDollar or my bank account) but not the other.

I wanted to gouge out my eyes. There’s no easy way to do this.

You Need a Budget

Moving Money

Similar to EveryDollar, it’s really simple to move money around.

Reconciling Transactions

All things bad in this department for EveryDollar turned out to be all things good in YNAB.

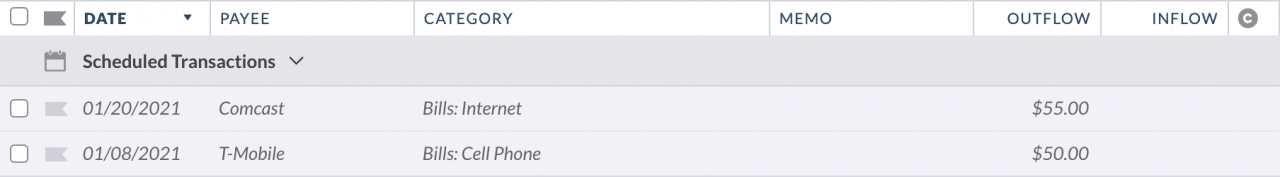

You can have scheduled (recurring) transactions.

YNAB also provides an extremely useful reconciling feature to ensure all transactions from your banks are in YNAB (and vice versa).

If you’ve stayed on top of adding transactions when they happen and your YNAB balance matches your bank’s balance, it’s a two-click process.

If your balances don’t match (maybe you forgot a transaction or two), YNAB gives you a simple way to add missing transactions until your balances match. To do this, you’ll still need to cross-reference your bank statements but YNAB provides built-in tools that make it a much easier process than EveryDollar.

What took 20 minutes of frustration in EveryDollar took 2 minutes in YNAB.

Winner: YNAB

By a huge margin.

I didn’t realize this was a deal breaking feature for me until the end of the month when I started balancing my budget.

For a budget to work, you have to be confident the numbers are right. Otherwise you may be spending money you don’t actually have.

Without a way to reconcile balances in EveryDollar, the process of checking for accuracy becomes a painstakingly slow and error-prone process.

Budgeting already requires a good amount of discipline. Make that process harder and you drastically reduce a person’s desire to keep up with it.

This is where YNAB clearly shines. It’s extremely easy to balance your budget each month.

I look forward to payday because YNAB makes budgeting a fun process.

Conclusion

YNAB is the clear winner here.

Once you get over the initial learning curve, it’s easier to use and stay on top of your budget. There’s a ton of resources including an active community and an incredibly helpful (albeit unofficial) Facebook group.

I would wholeheartedly recommend YNAB to anyone serious about getting their money under control.

I like to think YNAB helps you master of your money. You tell it what to do instead of the other way around. And by being in full control of what your money’s doing, you hit your financial goals much faster.

Ready to give YNAB a try?

YNAB’s offering a free 34-day trial. If you have any questions, let me know in the comments!

Also note, college students get their first year free!

Unfortunately, I can’t in good conscience recommend EveryDollar when it’s more expensive and is not nearly as good for budgeting as YNAB.

While EveryDollar might be a lot faster to get your first month’s budget set up, it doesn’t provide useful features/tools to keep the budget going strong over time. And that’s where you absolutely need a budgeting app to excel in.

And EveryDollar (the subscription version) encourages bad habits.

One of the most critical habits I’ve discovered to successful budgeting is adding transactions as soon as they happen. This keeps you more in tune with your spending and budget category amounts.

EveryDollar doesn’t automatically match existing transactions with automatically imported ones. That means if I add a transaction today, a day or two later when that transaction gets auto imported, I have to delete the imported transaction since the manually added transaction is already in my budget. If I don’t delete one of the transactions, my budget inaccurately gets hit twice.

And because EveryDollar doesn’t have reconciliation features, chances are these duplicate transactions will go unnoticed.

The solution to all this is to never add transactions as they happen and just rely on auto import which to me is not helpful and makes your category numbers 1-2 days delayed (waiting for transactions to import).

YNAB on the other hand will automatically match two transactions it believes are the same, making that process seamless.

That’s just one of many little things YNAB does so much better than EveryDollar. And why in terms of value, YNAB provides the better budgeting app for less than Ramsey+ (what gives you access to EveryDollar’s premium features).

If you pay month-to-month, YNAB is currently $11.99/month. If you pay for a year upfront, it’s $84/year.

Ramsey+ is $59.99 if renewed every three months, $99.99 every six months, or $129.99 every year.

It’s worthy noting you get access to additional content with Ramsey+.

Ramsey+ is an all-access membership to our best money tools, apps and content. With Ramsey+ you’ll discover how to take complete control of your money—and get the tools you need to make it happen. Your membership includes access to our online courses, including Financial Peace University, the premium version of EveryDollar, the BabySteps app, PLUS so much more.

The bottom line: YNAB is the the best budgeting app out there. And second place isn’t even close.

Once you get used to its budgeting methodology and the app, YNAB will literally change your life. It’s not an exaggeration. I’ve seen it happen in my own life, friends’ lives, and countless people in the YNAB Fans Facebook group.

What budgeting tool do you use? What do you like about it?

197 replies on “You Need a Budget (YNAB) vs EveryDollar”

Thank you so much for this! This saved me a at least a month and who knows how much time!!! The features you focused on were excellent, and your point about balancing the budget actually made me understand and realize why budgeting has NEVER worked for me, even when I had YNAB years ago. I never knew to balance it!!!! Thank you!

woot! thanks for letting me know this review helped you. it was really encouraging to hear! taking the time to balance (i.e. reconcile) every couple weeks is a critical habit. it really gives you confidence in the numbers since you know literally every penny is accounted for.

give YNAB another try. i probably started/stopped using YNAB a couple times before it finally clicked. keep at it. eventually it clicks and becomes a game changer!

Two things I don’t like about Every Dollar (I have Plus), that I’m wondering if YNAB would solve for me:

1 – Sinking Funds (funds that only need to be paid quarterly, etc. so I just set money aside for it each month and it rolls over)

2 – Inability to print the balanced budget at the end of the month. There is still enough “pen and paper” in me that I want to print out a report at the end of each month to have a hard copy to file away and refer to later or simply to review, paper in hand.

1. by default, YNAB treats every category like a sinking fund where money rolls over each month.

2. the three reports it has are: net worth, spending, and income vs expenses. i never use the reporting features, so i’m not sure if those reports will get you what you want.

We’ve been using the free everydollar for almost 3 years. You can turn any line in everydollar into a fund very easily. The fund balance then carries forward to the next month automatically. You can also create a fund with a beginning balance.

I don’t think you can “print” the free version of everydollar, but in the paid version you can export a spreadsheet for the month.

I am just beginning to try the Every Dollar free version. Do you have to create a “fund” in order for left over balances to be carried into the next month? And if so, how do I create a fund?

Also, where online can I go for help with ED? I have my initial budget created, which was simple enough. But what about the starting balances in my budget categories as I begin using ED?

I need help and I don’t think you can get this help with the ED free version. Thanks for your help and suggestions!

yes, for balances to carry over your have to designate it as a fund. when you choose a category in your budget, there should be an option to mark it as a fund in the category settings.

and last i checked ED, i believe there’s a help section linked to directly on the website/app. hunt around and i bet you’ll find it.

for starting category balances, you’ll just have to manually add those in to your categories before you build out each monthly budget. (this is an area where ED is not nearly as robust as YNAB.)

In YNAB, in order to print a report you need to export the data and open them a separate spreadsheet app, like Excel. You can select which categories to export. I’ve put in a request to include printable reports within the app itself.

Did YNAB discontinue all of their extended trials? Clicking on your link only says a 34 day trial. Thanks!

ahh! i need to update this post. yeah, YNAB recently stopped offering three-month trials. however, know if at the end of your 34-day trial you still need some more time, you can email support and they’ll extend it for you. they’re great about that.

I have been using Every Dollar since it came out and was shocked to see you mentioned how difficult it is. If someone like me who has a brain-injury due to a ruptured brain aneurysm could easily learn and quickly enter data into Every Dollar, anyone could. It took you twenty minutes? Really? And 2-4 days for your transactions to show up with Every Dollar Plus?

After using the free version for several years (it never took 20 minutes to enter in transactions but perhaps that’s because I generally don’t use a debit card except to pay bills), I switched to the Plus version. I have two financial institutions linked to it. The credit union transactions show up in real time, even though the transaction is still pending. The bank transactions do not show up while they are still pending. They show up once they have cleared which is generally the next day. In other words, this is an issue with your financial institutions, not the app.

the 20 minutes you’re referring to is how long it took me to reconcile everydollar transactions with my bank account (basically making sure i didn’t miss a transaction anywhere), not how long it took to add all my transactions. adding transactions was done relatively quickly via the mobile app.

and i would not describe everydollar as difficult to use. it’s actually pretty simple. the challenge is it’s feature set isn’t super conducive to maintaining a budget over the long term.

except you did….

“I wanted to gouge out my eyes. There’s no easy way to do this.”

I’ve been using Every Dollar for almost two years now and…I do love it as it provides some structure and saves time, but it ONLY really works if every transaction is a simple one. What I mean to say is, back in the day when you were young and just starting out, a notebook and pen was all you needed to keep a budget. But now, we have a combination of cash, automatic, and recurring payments that muddy the waters a bit. Staying on budget then means having both a paper (statements, notes, a register) and digital budgeting means (ED, YNAB, etc). I loathe spending a moment more than I have to on a complicated budgeting system. I’ve had the ED web version for a long time and I’ll admit that I use it a lot, every other day and I’m always getting caught up in the manual transactions part.

Case and point, the only budget categories that I can use all cash is: Groceries, Gas, some dog food, and that’s it! Everything of great quality is usually had in an online shop, so that means a lot of manual entries for recurring and non-recurring purchases. I can appreciate the free version of ED; however, it’s costing me money in the long run and I may…just may look into YNAB again. I had abandoned over a year ago when it was such a disaster to use. The envelope system just isn’t useful anymore.

i would definitely give YNAB a try again. i know sometimes it doesn’t always click. it took me a couple years of trying and quitting YNAB before i finally got into a groove. you can also look into using a tracking account to handle cash transactions. that’s a popular solution for handling cash in YNAB.

Alex,

I read a YNAB review you did back in 2016 and was desperate to get some budget help. Back then I was using Moneydance, basically an expense tracker.

I just wanted to jump on and say that I have been using YNAB for the last 2yrs and it got us out of the worst debt. I almost jumped in to ED, but your review was very helpful. ED would have been a nightmare for me according to its current limitations.

Thanks for being a part of our journey into getting out of debt, God bless!

that’s so cool to hear. thanks for dropping back in years later and letting me know!

What I like best about YNAB i sthat I can list all the bills that are due and the date they are due (just as part of the description) sort hem in date order and I have a bill tracking system so I am never late paying a bill. Can’t do that in ED

How do you sort them in date order?

YNAB supports scheduled transactions. if you use that feature, you can sort transactions in that section by clicking on the date header. it also sounds like she may use the memo field for dates? in that case, you can also click on the memo field to sort (assuming dates are entered in YYYY-MM-DD format).

Scheduled transactions was actually one of the spots where I got really confused with YNAB. I thought those transactions were happening because they’d been set up automatically, but then didn’t realize that some of them had stopped because they were still showing up in YNAB but not on the actual linked account (for one of my utilities, for example). I have spent so many hours trying to get YNAB to work for me and just end up feeling frustrated. We have a really inconsistent income (my husband and I are both freelance workers) so every month looks different. I’m curious if you have any insights and if we should give YNAB one more try!

I feel the same way about YNAB. I have used it several times, and it is not easy in my opinion. The setup was really confusing and I just couldn’t get it right. I’ve been looking into ED premium because it’s gotten great reviews other than this one.

what do u have for high schoolers lnew drivers first job dont know if college is for them

sorry, but i’m not sure i understand your question.

Great Article Alex! I have been using YNAB since 10/2017. I love it and it is so easy to use. Moving money, entering transactions, and budgeting for the future are a breeze. I also “track” my investment account for an overall “big picture”.

It is the first time in my life that i know the exact numbers of my current finances. (not just “close enough”). This has allowed to to fine tune my budget by seeing exactly where my money was going. I then cut my monthly expenses almost in 1/2. Well worth the small annual fee!

Also, fyi, all students get 12 months free of YNAB, so I highly encourage all students to try this budgeting software. This is from the YNAB website for those interested, “We offer all students YNAB free for 12-months (in addition to the free 34-day trial). If you’re interested, write into student@ynab.com with proof of enrollment—think student ID card, transcript or tuition statement (but anything that shows you are currently enrolled and includes your name, your school, and the date will do). We can’t wait to get you budgeting!”

I love, love, love YNAB!

Happy Budgeting!

oh, nice. thanks for that student reminder. i updated my post to let students know that’s an option.

This is awesome! I just sent them an email. I have been tracking my budget in Google Sheets for the last 3 years, and I”ve gone backwards ?!

Thanks Alex – Back in Jan2017, I had narrowed down my choices to YNAB and EveryDollar. I’m a fan of FPU but based on your earlier review, I decided to give YNAB a try first. My wife and I really like it. The main thing we like about YNAB is that it is very easy to enter transactions, particularly for geo-tagged locations that you frequent. With the app, entering a $10 transaction for a geo-tagged location is as simple as entering 1) “Add Transaction” 2) enter 1000 and 3) Save Transaction (10 seconds). For locations that are not geo-tagged, entering/selecting the additional payee, budget category/split and the account info is really easy (another 10-20 seconds maybe) … then you can geo-tag that location for next time!

Can’t say if EveryDollar makes this easier but my only complaint (if you can call it that) about YNAB is the simplified approach it takes to moving money around when you overspend a budget category. In short, YNAB doesn’t track when you move money between budget categories. Instead, YNAB simply changes the budgeted amounts. Example: Let’s say I initially budget $500 to “Groceries” and $200 to “Utilities”. Let’s say towards the end of the month I see I’ve already overspent my “Grocery” category by $50 but still have extra $75 in my “Utilities” category. YNAB makes it super easy to move $50 from “Utilities” to “Groceries” to cover the overage. BUT, it doesn’t create any kind of entry to show that I’ve moved money between the two. Instead, it simply changes the amount that I originally budgeted to each category; “Groceries” changes to $550 and “Utilities” changes to $150. I’m a “data+metrics” guy so I really wish that the movement of money was somehow tracked and reported because I think that historical data would help me see how out of tune (or not) I’ve been with those initial budget amounts.

Note: YNAB will even allow initial budget amounts to go negative if the budget requires. I get YNABs mind-set on this and mathematically it makes sense but it initially feels weird.

Having said that, I still recommend YNAB to my friends. The reason is simple – the “best tool for the job” is going to be the tool that you find yourself actually using. YNAB is a really good tool, super easy to use, super convenient, reliable and accurate. It syncs with all of my banks, even those that gave apps like Quicken a hard time (namely USAA). It did take a bit for me to learn to “let go” of my perceived need for metrics & data but I’m ok with it now … ultimately budgets are simple (spend less than you make) and YNAB has “given me permission” to keep my budget simple and under control … now I can leave the analytics, spreadsheets and graphs for my day job :).

heya mike, thanks for the comment about your experience with YNAB!

i agree that sometimes it would be nice having a log of me moving money from one category to another. thankfully, i don’t have to do that much nowadays.

however, early on, one thing that was helpful was looking at the average spent quick budget option in the right sidebar (on the desktop). if what i budgeted wasn’t close to that number, then i immediately knew i was probably under or overbudgeting. instead of waiting until that category went negative or had a surplus, i could budget a more realistic amount then and there.

that helped me move money around less frequently and provided a more realistic budget based on previous spending habits in a category.

In EveryDollar, there is a feature to turn some budgets into “funds” so you can track “savings” for literally anything you may want to set money aside for such as to pay for a trip or pay for yearly subscriptions etc. Is there a similar feature on YNAB?

I like the simplicity of EveryDollar and the fact that it is free, but based on your review, I’d be open to trying YNAB because of the convenience of balancing budgets.

this is one area where EveryDollar’s approach differs than YNAB’s. where everydollar has you create a “new” budget every month (with all categories reseting to zero each month—unless you mark them as funds), YNAB is more fluid month-to-month. so _every_ category in YNAB acts like a fund in EveryDollar.

so let’s say you have a non-savings category for groceries. you budget $500 a month to it. if you have $25 left at the end of the month, that money follows you to the next month. so instead of budgeting another $500 the next month, you only need to budget $475. then you can budget an extra $25 somewhere else.

imho, this approach is better for budgeting. if you underspend a category, you should be rewarded (by being able to use that money somewhere else). with EveryDollar, that detail/nuance is lost.

Thank you for your response. Fundamentally, I agree with you, so I’m glad I found this article. I will definitely be trialing YNAB utilizing your link for 3 months free.

Thanks!

Love the article. Seems very balanced. I’ve been using EveryDollar for about 8 months. I’ve liked how easy to use it is but I’ve been a little frustrated at how overly simplistic it is. It’s not powerful enough. This article convinced me to give YNAB a try.

That being said, I’m pretty sure you’re sponsored by YNAB (I mean, YNAB has a landing page with your name on it). I don’t really have a problem with you being sponsored by YNAB but I wish you would have publicly disclosed that in the article at the beginning. I don’t think you disclosed it at all. It’s very common for bloggers to disclose that they are sponsored by the company that they are reviewing but they will also talk about why and how they still love the product.

thanks for the comment. even though i am a long-time YNAB user, i did try hard to write a balanced review. happy that came across. i hope YNAB gives you a little more power behind your budgeting!

and you’re totally right, i need to disclose the affiliate relationship with YNAB. i went ahead and added a blurb towards the beginning of the post.

I tried to use the new version of YNAB however it would take days for the transactions to be imported from my bank, that was the downfall for me. If I’m going to have to enter each transaction myself might as well use EveryDollar since it’s free. I do own the classic version of YNAB but I like the fact I can access EveryDollar from my phone or computer. For me EveryDollar is the winner unless YNAB can update my transactions within 24 hours.

i used the classic version before on my phone. if you’re using dropbox to sync your data, you shouldn’t have any issues using YNAB classic on your phone or computer.

and since you already have YNAB classic, that’s the better option over everydollar, IMHO. overall, YNAB (web-based and classic) are just more purpose-built for budgeting than everydollar.

agreed, I really dislike how long YNAB takes to record my transactions, when I compare it to my Mint account the transactions are already updated whereas YNAB still takes days after Mint. This maybe the reason I don’t keep YNAB.

Thank you for the article. I’m a current YNAB Classic user, and I am ready to decide between coughing up the 6.99/mo for YNAB reborn or go with EveryDollar, which my employer is offering as a free company benefit. Difficult decision! But after reading your review, I feel I’d be more happy with sticking to the system I’m accustomed to.

haha, “YNAB reborn.” so your company will only offer everydollar even though YNAB would be similar in pricing? any chance you they’d grant you an exception? or you could just keep chugging along in YNAB4. plenty of people still do!

Thanks for this comparison. I was really considering Every Dollar until I read this article and decided to give the 3 month trial a go. Started it last week and I’m really loving it the more I use it and get used to it’s features.

I’ve been lazy my whole life when it comes to budgeting and I’ve never really had a true budget tbh, but I’m tired of living that way. This app really helps me understand the full scope of my income vs. expenses each month and then set goals, plan and be responsible with the remaining income that I have after I’ve paid all my monthly obligations. It’s only been a few days, but I can already see how this is changing my mindset towards financial planning. I will stick with this for the next 3 months, but already I’m putting the annual subscription in the budget because I’m pretty sure that I want to stick with this long term.

I will say that the price is not $50 annually anymore. Maybe it was at the time this article was written, but now it’s $83.99 billed annually. But if you’re a student they’ll give you 12 months for free.

sounds like you’re getting up to speed with YNAB pretty quickly and already seeing an impact. that’s terrific to hear. if you stick with it, i’m confident you’ll experience even more benefits.

and one quick tip … if you ever find yourself feeling behind, numbers not matching, or frustrated with your budget, don’t be afraid to do what YNAB calls a fresh start. it resets your budget so you can start with a clean slate. i did multiple fresh starts when i first started out. it’s definitely better to do that once in awhile instead of giving up on YNAB entirely.

I really enjoyed this article and it answered a lot of questions about YNAB. I like trying out different methods of budgeting and found that your review of EveryDollar is fairly accurate, except that recurring transactions can be transferred between each month. Once when you set up your bills and budget and the next month rolls over, it will ask if you are ready for the next month. When you click on it, your income and bills will automatically show up with each amount. Other than that, your review is pretty accurate and still the same with the current web version.

Either way, YNAB still reigns over EveryDollar because it’s easier to enter transactions through your mobile app, which is a big plus for me. I’m considering YNAB and will give it a go soon.

thanks for the comment! i’ve been meaning to update this post since YNAB has made some changes and it appears everydollar has as well. so need to make sure things are up-to-date for both apps! #onmytodolist