In the budgeting world, you won’t go far without hearing about Dave Ramsey’s EveryDollar. Being a long-time You Need a Budget (YNAB) user, I was curious to see how EveryDollar stacked up. Especially since EveryDollar has a free option.

Would EveryDollar be good enough to switch away from YNAB? Or at least worth recommending to friends who don’t want to pay for YNAB?

I used YNAB and EveryDollar side-by-side for an entire month and focused on three areas I believe are important for any app wanting to help people get their money under control.

How easy is it to:

- Create your first month’s budget?

- Add transactions from your smartphone?

- Balance your budget at the end of the month?

This post shares what I learned and crowns a winner!

Note: Because YNAB is a subscription service, I’ll be comparing YNAB to EveryDollar’s subscription service (called Ramsey+) with a separate section for the free version.

Test drive YNAB free for 34 day. And #protip, you can email support requesting extra time if that’s not long enough. They’re typically very generous honoring those requests!

Note: If you sign up for a free trial using links in this post, I’ll get a small commission. And please know I wrote this review before I knew I could earn a commission. It’s genuinely my honest, unbiased experience using both apps.

Creating Your First Budget

EveryDollar

Creating a budget is a simple process in EveryDollar.

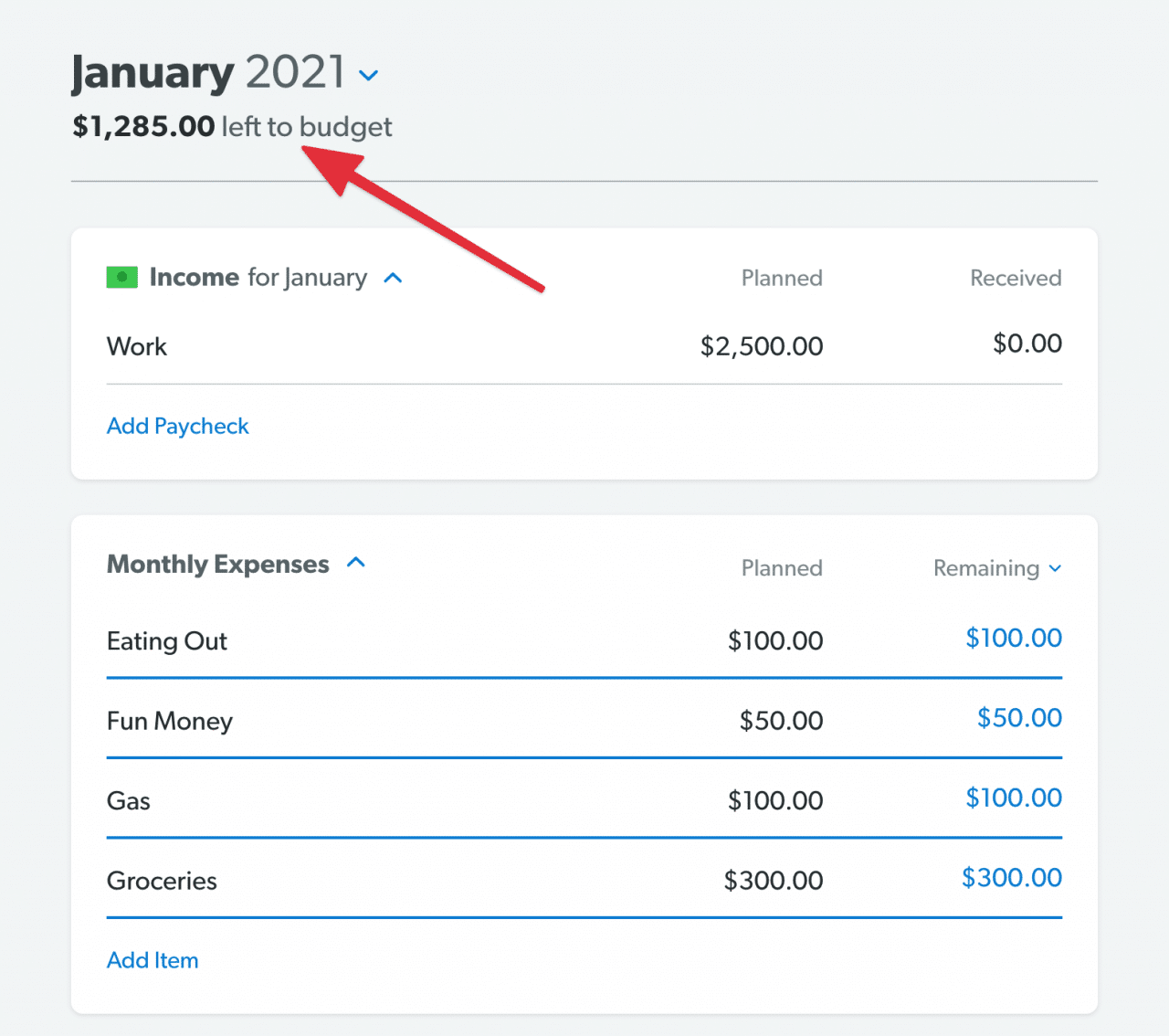

Once you create an account and log in, you’ll immediately be taken through a step-by-step guide that walks you through budgeting some of the more common categories. Afterward, you can further refine your budget to get the “left to budget” amount to zero.

You Need a Budget

Once you log into YNAB for the first time, you’re greeted with a getting started tutorial that’s definitely worth going through. It’ll walk you through adding your accounts (checking, saving, credit card, etc.) and their starting balances.

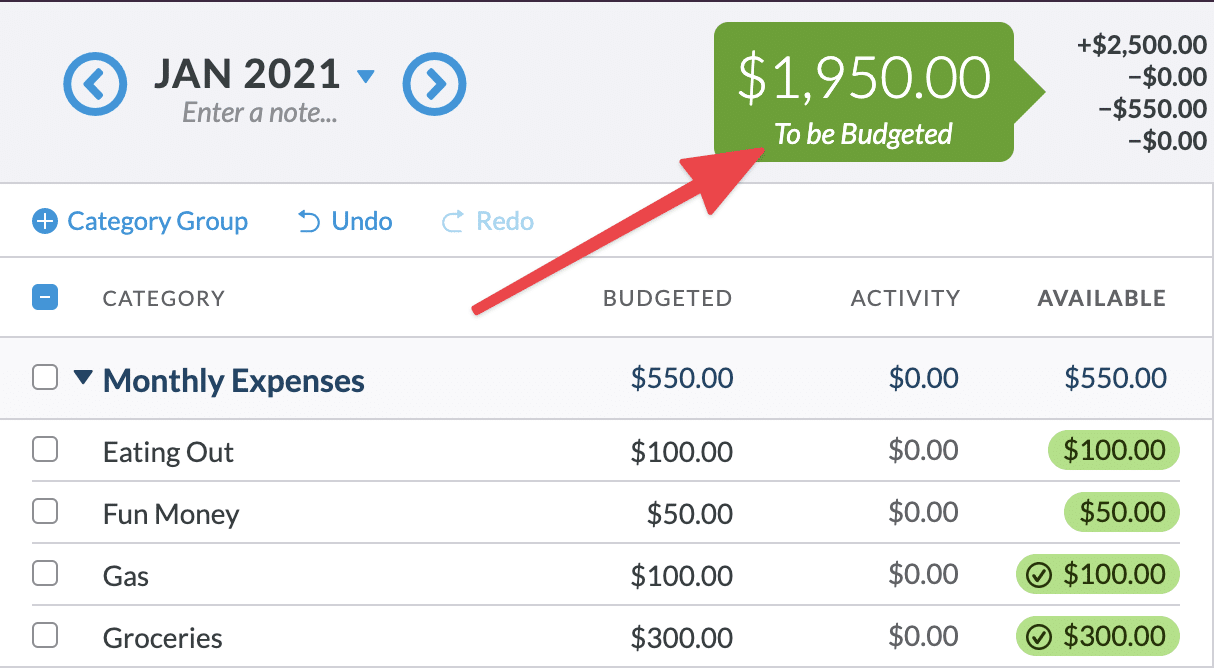

Similar to EveryDollar, you’ll then distribute your money into the different categories until the “to be budgeted” amount reaches zero.

The big difference here is that instead of budgeting a single month based off your expected monthly income (like EveryDollar), your first budget is based off how much money you have combined across your checking and savings accounts. This is because YNAB encourages budgeting using only money that’s actually in the bank (versus forecasting future income).

Winner: EveryDollar

There’s no question here. EveryDollar is definitely a lot easier and quicker to get started with. When you get in the “cockpit” of EveryDollar, it’ll feel familiar. Like most other budgeting apps out there.

However, getting into the cockpit of YNAB can feel a tad overwhelming. While YNAB’s approach to budgeting, handling of credit cards, and other features (like goals and reconciling) are extremely helpful, there is a learning curve to fully understand how and why they’re useful.

Adding Transactions

The best way to keep track of your budget is to add each transaction as they happen. That means the mobile apps for EveryDollar and YNAB are critical pieces to budgeting success.

The focus of this section will be on adding transactions on the iPhone.

EveryDollar (2020.11.30)

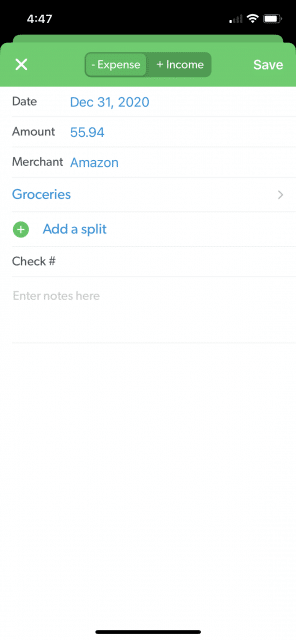

Just like creating your first budget, EveryDollar’s iPhone app makes it straightforward to add a new transaction.

Nothing fancy here.

Type in an amount, type in the merchant name, and choose a budget category. After entering a transaction, you can scroll to the category to see how much money is left (making sure you’ve toggled the Remaining view).

You Need a Budget (2.14.1)

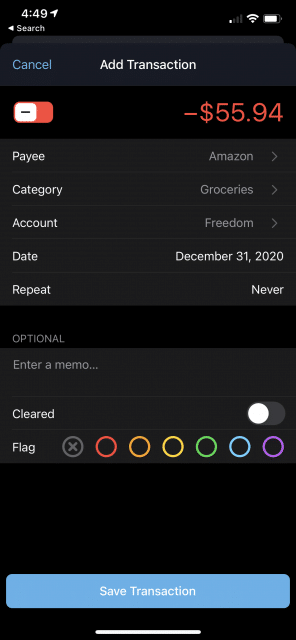

Let me just go on the record here and say YNAB’s iPhone app is gorgeous. It’s obvious from the start a lot of care went into designing YNAB (and how you use it).

You’ll type in the same things as you would in EveryDollar.

However, the strength of YNAB becomes more apparent when you re-visit a place you’ve already shopped.

More details later when I declare a winner for this section.

Winner: YNAB

There’s two noteworthy features YNAB has that EveryDollar doesn’t.

- YNAB uses GPS to remember all the places you shop at.

- YNAB uses default values whenever it can.

Both those things drastically speed up how quickly you can add a transaction.

The easier it is to use an app, the more likely you will be to use it. When it comes to staying on budget every month, this becomes an important point.

The second time you visit a store, YNAB will either pre-populate the payee with the store based on your location or show you a dropdown of nearby stores. YNAB will also default the category to the last one used for selected payee.

All this makes adding future transactions from previously visited spots a quick process.

On the flip side, EveryDollar makes you manually type out the store name (made somewhat quicker by predictive text) and choose a budget category every time you make a purchase.

Balancing Your Budget

I won’t get into a rant here, but if you don’t do this step regularly (at least once a month) then you’re not really budgeting. You’re just tracking your spending.

What does balancing your budget mean?

It means every budget category is at $0 or has a positive dollar amount before moving on to the next month’s budget.

If you overspend by $50 in groceries this month, you take $50 from a different budget category (one that has an extra $50 to spare) and move it into the groceries category to compensate for the overspending.

It could also mean “sweeping” all your surplus (money you budgeted but didn’t spend) into a specific saving goal or into more important categories.

Balancing your budget requires two things:

- An easy way to move money from one category to another.

- Confidence you’ve recorded every transaction for the month.

Now let’s take a look at how EveryDollar and YNAB stack up.

EveryDollar

Moving Money

It only took EveryDollar a few years, but they finally implemented an easy way to move money between categories. (Unfortunately, this is in the subscription version only. This feature is removed in the free version. 😠)

Reconciling Transactions

How about ensuring all my transactions have been added properly?

This was a nightmare.

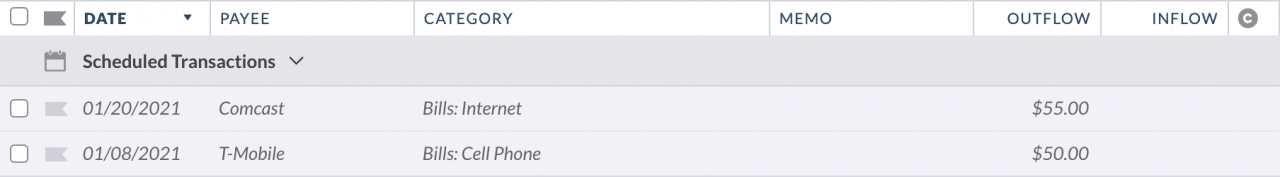

I have a bunch of recurring transactions (rent, bills, subscription services, etc.) that happen without me physically paying for them (which is generally my reminder to add a transaction into my budgeting app). With EveryDollar, all of those have to be manually added every month because EveryDollar doesn’t support automatically adding recurring transactions.

And I don’t always remember to add transactions on my phone whenever they happen. So how do I know which transactions I forgot?

Lots of manual labor.

I had to look at statements from each bank account and check line-for-line if I entered the transaction into EveryDollar. And use a separate interim spreadsheet to track what transactions were in one spot (EveryDollar or my bank account) but not the other.

I wanted to gouge out my eyes. There’s no easy way to do this.

You Need a Budget

Moving Money

Similar to EveryDollar, it’s really simple to move money around.

Reconciling Transactions

All things bad in this department for EveryDollar turned out to be all things good in YNAB.

You can have scheduled (recurring) transactions.

YNAB also provides an extremely useful reconciling feature to ensure all transactions from your banks are in YNAB (and vice versa).

If you’ve stayed on top of adding transactions when they happen and your YNAB balance matches your bank’s balance, it’s a two-click process.

If your balances don’t match (maybe you forgot a transaction or two), YNAB gives you a simple way to add missing transactions until your balances match. To do this, you’ll still need to cross-reference your bank statements but YNAB provides built-in tools that make it a much easier process than EveryDollar.

What took 20 minutes of frustration in EveryDollar took 2 minutes in YNAB.

Winner: YNAB

By a huge margin.

I didn’t realize this was a deal breaking feature for me until the end of the month when I started balancing my budget.

For a budget to work, you have to be confident the numbers are right. Otherwise you may be spending money you don’t actually have.

Without a way to reconcile balances in EveryDollar, the process of checking for accuracy becomes a painstakingly slow and error-prone process.

Budgeting already requires a good amount of discipline. Make that process harder and you drastically reduce a person’s desire to keep up with it.

This is where YNAB clearly shines. It’s extremely easy to balance your budget each month.

I look forward to payday because YNAB makes budgeting a fun process.

Conclusion

YNAB is the clear winner here.

Once you get over the initial learning curve, it’s easier to use and stay on top of your budget. There’s a ton of resources including an active community and an incredibly helpful (albeit unofficial) Facebook group.

I would wholeheartedly recommend YNAB to anyone serious about getting their money under control.

I like to think YNAB helps you master of your money. You tell it what to do instead of the other way around. And by being in full control of what your money’s doing, you hit your financial goals much faster.

Ready to give YNAB a try?

YNAB’s offering a free 34-day trial. If you have any questions, let me know in the comments!

Also note, college students get their first year free!

Unfortunately, I can’t in good conscience recommend EveryDollar when it’s more expensive and is not nearly as good for budgeting as YNAB.

While EveryDollar might be a lot faster to get your first month’s budget set up, it doesn’t provide useful features/tools to keep the budget going strong over time. And that’s where you absolutely need a budgeting app to excel in.

And EveryDollar (the subscription version) encourages bad habits.

One of the most critical habits I’ve discovered to successful budgeting is adding transactions as soon as they happen. This keeps you more in tune with your spending and budget category amounts.

EveryDollar doesn’t automatically match existing transactions with automatically imported ones. That means if I add a transaction today, a day or two later when that transaction gets auto imported, I have to delete the imported transaction since the manually added transaction is already in my budget. If I don’t delete one of the transactions, my budget inaccurately gets hit twice.

And because EveryDollar doesn’t have reconciliation features, chances are these duplicate transactions will go unnoticed.

The solution to all this is to never add transactions as they happen and just rely on auto import which to me is not helpful and makes your category numbers 1-2 days delayed (waiting for transactions to import).

YNAB on the other hand will automatically match two transactions it believes are the same, making that process seamless.

That’s just one of many little things YNAB does so much better than EveryDollar. And why in terms of value, YNAB provides the better budgeting app for less than Ramsey+ (what gives you access to EveryDollar’s premium features).

If you pay month-to-month, YNAB is currently $11.99/month. If you pay for a year upfront, it’s $84/year.

Ramsey+ is $59.99 if renewed every three months, $99.99 every six months, or $129.99 every year.

It’s worthy noting you get access to additional content with Ramsey+.

Ramsey+ is an all-access membership to our best money tools, apps and content. With Ramsey+ you’ll discover how to take complete control of your money—and get the tools you need to make it happen. Your membership includes access to our online courses, including Financial Peace University, the premium version of EveryDollar, the BabySteps app, PLUS so much more.

The bottom line: YNAB is the the best budgeting app out there. And second place isn’t even close.

Once you get used to its budgeting methodology and the app, YNAB will literally change your life. It’s not an exaggeration. I’ve seen it happen in my own life, friends’ lives, and countless people in the YNAB Fans Facebook group.

What budgeting tool do you use? What do you like about it?

197 replies on “You Need a Budget (YNAB) vs EveryDollar”

Great article – still relevant all these many months later. Thank you for doing this.

I have been a YNAB user for 5+ years (it could be longer, but who’s counting?). I am still using YNAB4.

The 1 critical item the online version doesn’t have is the ‘red arrow’ functionality. Long story short, we use it quite a bit – FSA reimbursements, business travel, the kids’ allowances, shopping (“I can’t decide which one I like better right now” – and yes, I insist they return the rest after they make a decision), going over budget on vacation, etc.

But the biggest reason for the functionality, in my opinion, is it makes budgeting more “palatable” to the rest of my family. It makes the budgeting process “forgiving”. We understand that spending more than has been “allocated” means we have to scrimp a little next month. But that is our choice. It is understood – and it is there in red and white for everyone to see.

I saw the work-around. I fully understand how “easy” it is. But getting back to a point you have made numerous times throughout the post: make my life simpler/easier and I will value the service. Removing that functionality makes things harder. I also think it would make the going over-budget situation less transparent.

We are on a really tight budget and having some “give” to deal with life is better than a “zero tolerance” stance. Can it be abused? Of course. Is my family abusing it? Perhaps. But using the tool, we have been able to live a “normal” life while still being fiscally responsible. I love the YNAB concepts – I am just a firm believer in not being too strict. If it is too strict, people won’t use it. IMHO, that is just human nature

thanks for the insight into why you still use YNAB 4! i think the key with budgeting is find what works and stick with it. happy to hear YNAB 4 is still working out for you.

Does YNAB work well if you have fluctuating income? My husband gets paid every 2 weeks so sometimes there are 3 paychecks per month. Also, he’s paid hourly and gets incentive pay so monthly income can fluctuate by several hundred dollars every month. At the beginning of the month, it’s hard to estimate what it will be.

yeah, i think YNAB is actually well-suited for people with variable income. YNAB even did an entire series on it.

https://www.youneedabudget.com/series/mastering-your-variable-income/

Incredible review and thread, thank you!! I am starting FPU in two weeks and am seeking a budgeting tool to assist with my journey to be debt-free and become a better steward of my financial resources. Thanks again!

thanks! FPU has a lot of great, foundational teachings. partner that with YNAB and you’ll have a winning combination for hitting each baby step.

It is possible to use YNAB to print out tax reports at the end of the year? One comparison I viewed said that everydollar had this capability while NYAB did not. True or false?

i’ve not had to print anything, however, i don’t believe YNAB natively supports printing. however, the YNAB toolkit does. i use the toolkit for other small improvements to YNAB, so definitely worth checking out.

and there’s no tax-specific reports in YNAB. if you want to isolate specific things for taxes, i would create a separate category for that. and then in your reports filter based on that category.

the other option if you don’t want to install the toolkit is to just export your transactions to a CSV. from there, you can filter by your tax category.

Hi Alex, Sorry iff this is covered elsewhere, but I am considering YNAB. Three quick questions:

1. Regarding adding transaction and the related conveniences offered by YNAB, how does YNAB ask you to handle at a single Starbucks visit the time you buy a coffee (tracked as a fun expense), a bag of coffee (tracked as grocery expense) and a coffee appliance (savings goal) at Starbucks. Are these to be entered manually as 3 separate transactions?

2. If you do a manual entry, would YNAB automatically figure out a duplication when it later imports the banking info?

3. What does importing banking account info mean anyway? Transactions get recorded in YNAB by category that you assign during the import process or is it all automatic, which would be too good to be true!! Some payees as recorded by my bank are sometimes at first glance unrecognizable to me when I see my account.

Thanks for the great review information.

1. you would create a split transaction for this in YNAB. so you’d enter one transaction but split it into three different categories.

2. yup yup. this happens to me all the time. YNAB will automatically match imported transactions with manually entered ones.

3. i’m not sure i understand the question entirely. but i’ll just talk out loud and hope it makes sense. ;)

if YNAB auto imports a transaction you haven’t manually entered yourself (so it has nothing to match to), YNAB will see if it’s a recognized payee. if it is, it’ll use whatever category was used last. if it’s not recognized, then it’ll ask you to choose a category (and then remember it for later).

YNAB also attempts to clean up payee names to something more friendly. for example, if YNAB knows “* PayPal AMBIGUOUS NAME” is actually “Friendly Name” then it’ll import is as “Friendly Name” for you.

hope this helps!

Alex, I doubt you’ll agree with my approach, but does nYNAB require a budget to work? We have plenty of money, no debt except house (will be paid off in a few months), no kids, hubby and I both in late 70’s & retired, investments covered. All I want to do is track expenses. I have a lifetime of frugality, single mom supporting 3 sons on a shoestring and never going into debt, every bill paid on time. It’s instinctive with me. I have started ED+, but it demands a budget and I’ve read this whole blog about its shortcomings. We used mVelopes for 3 yrs. and gave up b/c of the non-existent support, a beta version which was awful, and a pdf that was supposed to pass for Excel. We wasted a lifetime membership which was not refundable. Worst company ever! What software would be most useful for someone like me and can I use it the way I would like? Thanks for your reply. Forgot to mention: Downloading and splitting transactions is a must!

while you could use YNAB to just track expenses, i don’t think YNAB would be the right tool for you. how did you handle income in mvelopes? mvelopes, similar to YNAB, wants you to budget that money across categories.

the only thing that makes me _think_ YNAB could work for you is that you’re coming from mvelopes. those two tools are really similar in their approach to budgeting.

have you tried mint before? while i abhor mint, it is more designed as an expense tracker than a budgeting tool so could work in your case.

mint might be better for you. I’m a ynab user, former minter and I found mint to be good for tracking spending but not much of a budget App.

We clicked on the link for a 90 day free trial, however, when I downloaded the app from iTunes, it only offers a 30 day free trial. Anyone successful in getting the app for 90 day free trial, too?

yikes, sorry for the delayed response. if you click the link and create an account before installing the app, you should get the 90-day trial. then sign in via the app. you can confirm the trial length by visiting your account page.

https://app.youneedabudget.com/settings

Alex, Yes, that is what we did and it was confirmed with YNAB support. Thanks for replying!

I did this as well and can’t seem to get the 90 days. It will most likely take me more then 30 to get the hang of it.

hmm. not sure what’s going on here! so on your account screen in YNAB, it shows the standard 34 day trial and not 90 days? did you click on the 90-day trial link in my post and then created an account after clicking on the TRY YNAB FREE FOR 3 MONTHS button?

YNAB would be a superior product if the import sync wasn’t just so horrific. I guess if you want to manually enter all of your transactions, it’s fine, but who the hell has time for that?? For those who don’t like the ideological orientation of only budgeting the money you actually have, it is a definitely specific way of thinking and I didn’t like it at first. But once I decided to try to think about budgeting that way, I came around, and I am a big fan. There is a very specific way of thinking about spending that the software is based upon. Despite the great things about YNAB, I am desperately looking for an alternative because their sync is so bad and I don’t have time to manually enter 100+ transactions every month.

I spent 5 minutes trying to set up an account on EveryDollar, but their ideological founder is so anti credit card that you cannot even use a credit card for the 15 day free trial. As a prior victim of identity theft I will never again use a debit card for an online transaction. It makes me think this company isn’t very security-minded. Guess I’m still stuck with Mint, at the end of the day. Darn it.

at least with my banks, they’ve significantly improved the reliably of the syncs. i haven’t had an issue in months (whereas in the past, it would have sync errors at least a couple times a month).

and coming from mvelopes (which supported sync) to YNAB 4 (which didn’t), i thought the manual entry would be an issue for me. however, it became a non-issue. it’s now pretty habitual for me to add the transaction as it happens. that usually takes no more than five seconds.

I’m trying to get into YNAB because everyone seems to like it but I’m having two big issues:

1) It doesn’t allow me to import my checking account data because it won’t sync with my bank

2) I want to budget for the full month not only what I have, that’s ridiculous, there’s no point to a budget if I’m not planning out the full month of future income and expenses

1) there is a file-based import option if that’s a suitable alternative for you.

and having come from YNAB 4 where there was no auto-importing, it wasn’t that hard back then getting used to manually adding transactions as they happened. while it did take some intentionality to begin with, it was less of an issue than i had imagined it to be.

2) do you have at least a month’s worth of income saved in an emergency fund or other general savings account? if so, you can use that money to budget a full month at a time as opposed to waiting to budget each paycheck.

How can you possibly find time to manually enter all of your transactions? I went for 10 days once and across all of my accounts there were over 200 transactions waiting to be imported and cleared. It would have taken me forever to manually enter that! And what if you forget one? Then you have to also manually balance every account every month. Isn’t the main point of this software to get away from what any one of us could do in Excel?

Tony makes a good point. you should be aware of each transaction and making sure that you are staying within your budget. But manually entering transactions doesn’t scale well.

It’s fine when you have more time than transactions, but after you add more transactions and accounts ( say, get married, have kids, run a business or 2 ) it will quickly suck up time that could be better spent making more money or spending more time with your loved ones.

dang, that’s a lot of transactions! but as i mentioned earlier, once you get used to adding things at the register, it becomes easier than you might think. i often have the transaction added before the receipt prints or my card gets approved.

and scheduled transactions in YNAB helps with with transactions that happen on a set frequency.

i also balance my accounts regularly. it’s one thing i find extremely important to me. in order for me to trust my budget numbers, i have to be confident the balances are accurate. so i reconcile my accounts about once a week.

since i haven’t had the import uses you’ve had, that’s actually a really quick process.

Commenting on your second issue. I agree. I love YNAB, but if I’m following Dave Ramsey’s plan, I need to budget for the month ahead not just wait until the paycheck comes in. I tried to make the old YNAB budget ahead (categorize the money I was set to receive), but it was a disaster and not really what YNAB wants you to do. I know one of the main goals of YNAB is for you to get a month ahead, but I’m not in a place to earmark money towards that just yet.

@Chirst

In regard to #2… They only want you to budget the “cash” you have, but you can create you budget template which is what you are looking to do at any time. That is what I did …. I budgeted only the cash I had i.e. “gave every dollar a job,” then I created the rest of my budget setting up goals per month, yearly, etc.. Please visit creating a budget template… Then once you get more cash you can assign to your template.

https://docs.youneedabudget.com/article/915-budget-template

Sorry, but I see YNAB as the novelty of the tool eclipsing the necessary utility sought. People are into toys; it’s a natural inclination, and technological toys are especially alluring.

The monthly cost may not sound like much, but $84 a year pays for two months of utility bills in my area. That’s excessive in my book.

having used many different budgeting apps over the last 10+ years, i don’t view YNAB a a novelty. imho, it’s the app most purpose-built for budgeting.

but as with most spending, it all comes down to what you value. for me, $84 is easily worth the confidence YNAB gives me in my finances.

I have to agree that at least for me, the best thing about YNAB was that it did change the way I thought about budgeting. One of my initial problems was that I had to budget for the month, but got paid twice a month. The immediate problem was that my income was lower than my expenses at the beginning of the month, because I was living paycheck to paycheck. I had to make a few adjustments, and it took nearly a year, but now my total income from last month is what I use to budget for this month — which is where they are trying to get people to go, and is generally good policy.

Hey I just wanted to say thank you for such a great review. This is EXACTLY the information I was looking for, as I have been debating between the two services. Also, many thanks for the 3-month trial link. I just signed up and I’m already in love with the site and will definitely continue beyond the trial. Happy New Year!

yay! i’m so happy to hear the review was helpful to you. enjoy the trial. be sure you take a look at all the classes and all the resources under the support section of their site! those will help you get up-to-speed quickly.

Thanks for this review! I’m keeping an eye out for alternatives to YNAB – sounds like EveryDollar isn’t it.

is there something about YNAB that doesn’t fit the bill?

The price

That’s a reasonable reason. I’m just at the place where I believe the yearly cost is absolutely worth the peace of mind and convenience it gives me. Something none of the free tools out there could give me.

$83 is reasonable and well worth it, the money you will “save” because you are becoming more aware of your spending will more than make up for this, with the 3-month trial that’s less than $30/month to budget and then roughly $7 month after the trial and if you refer other people you get a free month if they sign up.. We went from running in the overdraft every month to slowly growing our balance, paying off debt and saving for a big house repair this spring.

Many people I’ve heard say they are discouraged by the price but these same people have cable TV, Netflix + and/or other streaming service memberships, prime memberships, gym memberships, etc costing $100’s if not $1,000’s a year. None of those truly benefit you in any way but you’ll spend the money anyway. You could argue that the Gym benefits you but you can find other ways to exercise that costs nothing and on that same token you could track everything in a spreadsheet or use one of those free tools but they won’t compare to YNAB. I’ve told a few friends aboutYNAB and two of them decided to try MINT instead because it was free, it lasted about a month before they quit using MINT and went back to their old ways of doing things of not knowing where their money was going.

anyway, just my 2c worth.

Thanks for the great review! I have been a YNAB 4 user since it came out (actually used the previous version before YNAB4). I am hesitating with switching to nYNAB for a couple reasons so I’ve been “shopping around.” Sounds like I should stick with YNAB and upgrade. Would love to hear your thoughts on these concerns:

1. I am not okay with taking from one category to pay for another. Instead of paying $300/mo in heating for 4 months per year, I’d rather put $100/mo into the category. Similarly, each family member has a “slush” category that we use to save up for big purchases. This means we carry forward a positive balance in that budget category for a few months before the expense hits. And, if we go over in that category one month, we want the negative balance to carry forward so we can focus on paying it down. I realize this means we aren’t truly “budgeting” each month. But, we like having the flexibility in this one category for each family member. Does the new version allow for that?

2. I prefer to manually enter my transactions and then go through each month’s statement line-by-line to make sure nothing was missed. I originally thought that the online syncing would make this impossible. But, it sounds like the nYNAB pulls transactions off your credit card’s online account and automatically matches them with manually entered transactions that you later approve. What happens when it pulls a transaction from your credit card online that was not manually entered? Does it mark it somehow or require some other kind of approval?

3. Is there a way to “flag” transactions in the new version? I use this currently for online purchases – I flag them until they are delivered. It’s just a way we make sure we don’t order something that gets lost in the mail and then we forget about it (we’ve got 4 users in the house, so our Amazon/Zappos/Etsy accounts are pretty active!).

Thanks again for the great review and in advance for your reply!

heyoh! let’s see about your questions …

1. yeah, that method of budgeting (the red arrow) isn’t supported by YNAB anymore. there are some workarounds that would get you that functionality, but it wouldn’t be as seamless as YNAB 4.

2. all imported transactions require approval (even ones YNAB matches with a manually entered one). you will know whenever YNAB imports a transaction you didn’t manually enter because it’ll require a category. and YNAB makes transactions requiring a category stand out.

3. yup, you can flag transactions with different colored flags. similar to how you can in YNAB 4.

You can still carry a positive amount over month to month. I use this constantly for water bills, estimated tax bills, savings goals etc. If you have excess budgeted one month, that amount will carry over to the next month.

However, if you have a negative amount in a budget category, that will not carry over. It will reduce the amount of money you have to budget for the next month. I understand why nYNAB removed this functionality, but I do kinda miss is.

nYNAB still kinda makes you review all your transactions. When you manually enter one, it does not show as “cleared” until it is matched from an imported transaction (or you manually mark it as cleared), and you click to approve it. If it’s a transaction you do a lot, it will automatically add a category (which you can change), but if it can’t figure out a category for it, it will make the transaction really stand out.

Thank you for your great review of YNAB and Every Dollar. I am trying to work on our budget for November and, as every month prior to this, I am having trouble using YNAB getting my inflow budget to show up on my November budget. It seems like it should be so easy but… I go to the Accounts page, input our monthly income in the inflow category and save the information then go to the Budget page and click on Quick Budget (I believe) to fill in the amounts that we budgeted last month and then adjust them as needed but when I go to Budgets nothing shows up! I’m so frustrated so I thought I would check out Every Dollar but think I will stick with YNAB and try to figure this out… once again. :( Other then getting started each month I have really been enjoying YNAB!

hmm. i’m not sure what’s going on. but it’d definitely be worth reaching out to YNAB support. they’re really good with helping people troubleshoot those types of things.

Okay, sounds good, I’ll have to do that.

Thank you!

I have tried YNAB several times and just have lots of trouble with it. I’ve used Mvelopes for years. Does YNAB have funding profiles?

YNAB does not have funding profiles in the way mvelopes does.

the closest thing is what YNAB calls quick budgeting options. it lets you select some or all categories and budget based on certain options (the goal amount, average spent, what was budgeted last month, etc.).

while not as flexible as funding profiles, it does make budgeting multiple categories faster.

Thanks. I’ll keep trying YNAB through the free trial. But, will still recommend Mvelopes to friends that are going through Dave Ramsey’s program. Tried Everydollar too. None are perfect, all are adequate, but in the long run still prefer Mvelopes.

Alex, Can you do a review on Mvelopes vs YNAB? I did a google search to see those two specifically compared to each other and found nothing within the past year (except a very generic categorized feature comparison of many budgeting websites/programs that was too broad).

I’ve been using Mvelopes for 8 years now (and will likely never change because they were dumb enough to offer a lifetime subcription model at $300 for a limited time and I jumped on it), but I find myself somewhat unhappy with Mvelopes. The UI is dreadful and often unintuituve, but I haven’t found a good replacement. I want to recommend the best product to friends/clients ultimately, but don’t want to spend the time/money learning a new system when mine works. Below are my FAVORITE/HATED features of Mvelopes (generally in order of best/worst and worst/best) that I would be interested in knowing if YNAB tackles in particular since you are a user of YNAB (but a review would still be awesome!).

LOVE

1) Split transactions across multiple categories (CRITICAL)

2) Credit card transactions-takes amount out of destination envelope and moves it to envelope for credit card payment so that you don’t overspend (CRITICAL!)

3) Tagging transactions- great for taxes or tracking specific things like how much my wife’s tuition cost vs my tuition when both types of transactions are in the same envelope (CRITICAL)

4) Net worth tracking

5) Reports- love that you can do it, hate how it is presented (confusing, unappealing visuals, and exporting to printed copy leaves you with an ugly excel sheet or an ugly PDF)

6)Auto download of transactions from institutions (CRITICAL)

7)Ability to set rules for auto-assign to certain envelopes – (these transactions go to an “auto-assigned” tab that shows you all of them to approve individually or en mass by clicking “Approve All”

8) Debt Reduction Center/Assessment- this is only with the “Plus” plan which is fairly expensive at $19 a month, but good for people in serious debt (NOT CRITICAL at all)

9) Add notes, tag, picture of receipt to any new or pending transaction

HATE

1) “Online Balance” in mvelopes doesn’t match online balance on bank website- this is because the bank includes pending transactions affecting online balance but Mvelopes doesn’t-leading to some VERY confusing chat sessions when trying to balance things. About every 6 months I wind up having to fix an issue where a transaction was missing or duplicated at some point without me realizing it, and I have to go back and adjust the starting balance of said account and assign the difference as a random transaction. These two related annoyances are my #1 complaint with mvelopes because it results in wasting a lot of time troubleshooting.

2) Pending transactions don’t download- I want the ABILITY to make a pending transaction, but still want my finance app to identify pending transactions automatically without having to stop every time I make a purchase and type the following fields on my phone: Amount, Payee, Account, Envelope. I read that YNAB is better at this with at least geo-based suggestions on merchant.

3) Auto assigned transactions won’t match with pending transactions- Ex) shop at walmart is usually groceries so you have it auto-assigned to that category, but today I spend $50 on DVDs and add a pending transaction. When $50 transaction clears and comes into Mvelopes it goes to auto assigned tab but won’t present “match” button with pending transaction like it would with a normal new transaction

4) Bugginess of website/app- Sometimes pending transaction on phone wind up consistently different than pending on web-based- I currently have two transactions from May as pending which actually were matched and assigned on web version but still show on my phone. Also, had consistent issues for almost a year with Net Worth feature not populating the visual line graph and instead only showing numerical values before they finally fixed it.

5) UGLY UI/experience- Mvelopes feels like a 2005 program that never really got better.

6) Support- Mvelopes support sucks. Their engineers often take a 1-3 days to fix an issue, and their chat function takes forever to communicate problems/solutions and is not available on weekends…..which is often when I catch up on budgeting.

thats an impressive comment! i’ll do my best to answer everything.

truthfully, i don’t see myself reviewing mvelopes because i know it doesn’t stand a chance against YNAB. i was a long-time mvelopes user and left it for YNAB. they were the first budgeting tool that made sense to me. i was also a user around the time they offered a lifetime subscription and have one of those myself!

ultimately, i left mvelopes because of a HORRIBLE user experience and a feeling things were getting worse, not better. their flash version was decent but when they “upgraded” it, that was a regression in my book. and it shocks me to see that same version is still in existence now (6+ years later).

now to go through your love/hate points.

LOVE

1. YNAB supports split transactions across multiple categories.

2. YNAB does something similar. if you spend X dollars in category Y on a credit card, X dollars will be moved to the credit card payment category.

3. doesn’t support tagging as a “native” feature. however, you could use the memo field and roll your own tagging feature.

4. it does track net worth, however, i don’t use it. i think personalcapital.com does a better job with net worth tracking.

5. YNAB has some basic reports that are visually appealing. but i don’t honestly use them that much so not super familiar here.

6. the web-based version of YNAB does auto-import transactions from supported banks.

7. YNAB supports auto-assigning certain payees to a category and scheduling recurring transactions.

8. not sure what the debt reduction center does so can’t comment if YNAB has something similar.

9. YNAB doesn’t let you add notes or pictures to transactions. as i mentioned above, you could add tags via the memo field.

HATE

1. you’re going to have a similar issue in YNAB where the balance in YNAB won’t match up with what you have in your bank. however, that’s considered expected with YNAB. where i think YNAB will help is it’s reconciling feature. that’s a god send when it comes to being confident your budget is accurate. YNAB’s reconciling features are excellent. if you reconcile regularly (2-4 times a month) you will be able to avoid time consuming troubleshooting later down the road.

2. not downloading pending transactions is pretty standard behavior across all budgeting apps. so YNAB won’t be any better here. as you mentioned, you’ll need to manually add those if you want them there before they clear your bank.

3. YNAB will automatically match a cleared transaction with one you manually added beforehand. i do this all the time. i’ll enter a transaction in when it happens, it’s pending on my CC for a few days, clears and then is imported and matched with my manual transaction automatically. i just have to approve it.

4. haven’t ran into any major bugs with YNAB’s desktop or mobile apps.

5. YNAB is gorgeous. particularly the mobile apps.

6. YNAB support is fantastic as well as their forums. there’s a ton of helpful resources out there (including Facebook groups).

Thanks Alex! Appreciate the follow up and I might check YNAB out.

Thank you so much for this extensive, detailed review and your follow up comments to questions from the community. I know I wanted a budgeting app but couldn’t decide. Mint and ED didn’t seem as intuitive and I didn’t want to waste a ton of time trying then abandoning different apps. I really appreciate your work and responsiveness here. I hipe you’re an affiliate, I’m going to scroll up and make sure to click through one of your links to sign up since your done so much work to make my choice easier. Many Thanks, Jen

you’re welcome, jen! and thanks for clicking through on my link. it is an affiliate link!

Fantastic review Alex. Thank you! Though you do have one glaring error in your monthly pricing $99/year would be $99/12 = $8.25/month for EveryDollar Plus not $14.99/month and $50/year would be $50/12 = 4.1666667/month for YNAB not $5/month.

heya bob, i can see how my wording could’ve been confusing. i’ve reworded it to make it more clear that there’s an annual option and a month-to-month option.

Ah … I see what you were trying to say. I’ve been on both sites and do not see a month-to-month option, both are annual only from what I see.

Thank you for this comparison. My first year of YNAB is about to run out this month and I’ve been considering switching to Every Dollar based on the one thing that I think ED does, but YNAB does not- the ability to budget your “to be budgeted” money around on the app. So far, I don’t believe that is possible with YNAB and it is super frustrating to me, who rarely takes the time to do anything at a desktop anymore. But those other downsides of ED sound more frustrating to me than this one thing! (Fingers crossed they’ll add that feature to the app soon!)

there’s a new version of the mobile app currently being tested that lets you manage your budget from your phone.

so the feature is coming just no idea of timeline. hopefully soon since it seems like they’ve been hyping the release for awhile now.

You can do this now in the YNAB app!

Alex,

Thanks so much for this. We were about to try out EDP but you saved us hours! Also excited to hear that your a disciple of Christ! Go Jesus!

go jesus! and happy to save you some time. hopefully YNAB will be as great for you as it’s been for me!

Dear Alex,

I used EDP for about a year. I found it easy to use at first, but became frustrated with little things. I agree that the inability of the program to simplify the input of my expenditures was annoying. Everydollar never recognized repeat payments (such as my monthly mortgage, etc). One of my biggest frustrations was their customer support. I could email or call, but I preferred to contact someone in person. Neither way allowed me to have a timely response. I usually had to wait for an email reply ( at least 24 hours). If I called, Instead of having me call a specific number and wait for support, I had to request to have a support person call me back. Of course, I would often miss the call – which might be a day or two later, and then we’d have to play phone tag to connect, and when I connected (finally) it wasn’t always at a convenient time to share my question. I also think that ED’s $90 fee is a bit pricey. I can buy quicken for about the same price and have a program that offers so much more. ED also only tracked data for about 8 months, and I was frustrated when trying to access expenditures with it for tax purposes.

everything you shared it pretty much why i don’t recommend everydollar to anyone. you get so much more for less money with YNAB.

Actually, more importantly, are you able to speak to the security of both? I find I’ve come the place where I hand over my bank account login information and it’s making me very nervous.

both services use a third party provider to connect to your banks and import transactions. those third party providers are secure by nature of what they do. so i’m confident in their security on that side.

in general, i’m not worried about security. partly because using either of those tools regularly will let you catch fraudulent charges early.

however, if you want to increase your security, be sure you have different passwords for all your bank accounts.

YNAB also has manual import, you can log in to your bank’s site and download the transactions and then import them into YNAB, I just love the direct import feature it makes things a lot easier to keep track of your actual balance.

I’m wondering, since DR’s big thing is paying off debt, if EveryDollar is any good for that function? I don’t know a lot about either one, and haven’t tried them yet. Trying to see which is better for me first.

imho, having a solid budgeting habit and app is the quickest way to pay down debt. so in that sense, i don’t think everydollar is good at helping you pay off debt since it’s not a great budgeting app.

if you imagine paying debt like cutting down a giant tree, YNAB is using a chainsaw. everydollar more a hacksaw.

YNAB is just better suited for budgeting your money which in turn helps you pay down debt quicker (or save more).

Agreed YNAB wins. Another big benefit is support for negative transaction amounts – my paycheck has a lot of these, and I like to keep track of them (how can I see what I’m saving if one of my major savings – 401k – isn’t accounted for).

In addition, EveryDollar’s absolute refusal to import American Express accounts (due to Dave Ramsey’s personal issues with the company) is a killer – I get 3% back on groceries with my AMEX Blue Everyday Card, and with a family of 6, we buy A LOT of groceries.

One benefit of EveryDollar in the budget balancing arena is that it allows me to balance budgets over time rather than across categories. For example, if I overspend on entertainment in June, I prefer to cover that by reducing entertainment spending in July, not by taking money from groceries. The only way to do this with YNAB is to “steal” from one category in June, then “pay back” from that category in July – which is two separate adjustments; it’s automatic with EveryDollar.

ahh, so you’re saying you add your paycheck to YNAB using the gross amount and then split it so that it shows your 401k deductions, taxes, etc.?

and i see what you’re saying with everydollar on letting a category go negative and compensating the next month. i prefer forcing myself to compensate in the same month. namely because i used to tell myself i’d spend less next month but inevitably i wouldn’t. so i’d constantly be in the negative month to month.

it’s just easier for me to handle it in the same month.

and help me prioritize. if i overspend in entertainment by $50 and have to take $50 from clothes, having to ask if i’m okay having $50 less in clothes is a good mental exercise. if it is, then no harm no foul. if it isn’t, then i will feel that pain which makes me more aware of my entertainment spending next month.

I still use YNAB4. I’d make the switch in order to use the mobile app except for one change in nYNAB… can’t carry forward negative category balances. I have large bank balances and often spend money that is eventually reimbursed by my employer, sometimes after a couple of months. The inability to carry forward negative balances is a deal breaker. Do you know of a program that does what YNAB does, but allows carrying forward negative balances?

unfortunately, i haven’t come across another program.

i’ve worked around the negative balance carry over by just funding a “to be reimbursed” category with $500 (enough to cover the max amount of reimbursements i’ll have at any given time). that way i never have to worry about a negative balance.

for someone who is pinching every dollar for other expenses, it may not be a doable alternative. however, if you have extra savings, i definitely recommend that method. it simplifies a lot of things with tracking reimbursements.

Alex this is the most helpful review of these two products I have found yet and I’m very grateful. You answered all of my questions and now I can continue using YNAB with no looking across the fence at ED! Thank you :)

aww, thanks for your kind words! happy it was helpful to you!

What would you recommed for someone who is self-employed and doesn’t have a set amount coming in each month? I’m a mystery shopper and work with dozens of companies, though not always the same ones each month. And I pay out on various shops, from restarants to theatres to car repair shops, and get reimbursed anywhere from 4-10 weeks later, along with a shop payment that ranges from $4 up to $50 or more. What would track my spending, allow me to save and let me budget with such vastly changing numbers each month?

i’d still recommend YNAB. for someone with a variable income, it’s probably even more important to budget so you can ensure you have the money available in “down” months.

YNAB has a whole series dedicated to people with variable income. i’d recommend going through those posts to learn what they’d recommend.

https://www.youneedabudget.com/category/variable-income/

are your reimbursable expenses paid from a credit card or debit/cash?

Hi Alex,

I’m a former YNAB classic user but it’s been YEARS since I used the program. Considering getting back into the budgeting game again and using the new YNAB. Now that it offers to connect to all accounts online, is there a problem with duplicate entries between syncing accounts after entering transactions manually via the phone app? Or, is it smart enough to recognize I already entered a transaction manually? Hope this question makes sense!

Also, thanks for this great comparison! I’m more interested in YNAB more than ever.

nope, no issue at all matching manually added transactions with ones automatically imported. i do this all the time. (and actually think it’s good practice to manually add all transactions as opposed to rely on the import—since the import is delayed anywhere from 1-4 days.)

hope this encourages you to get back into the budgeting game!

Thanks, Alex. But are the entries duplicated and one will need deleting?

entries are not duplicated. YNAB will combine both the manually added and imported one into a single transaction which you then “approve” to make sure it was matched correctly.

Alex, amazing review and replies! Cannot thank you enough.

Hi, Alex, have you compared NeoBudget and YNAB? They seem kind of similar on the surface, though I don’t know a whole lot about either except cursory reading. NeoBudget’s presentation on their site is cleaner, but I’ve actually never used an envelope system or $0 budget. For a decade I’ve been keeping track of all my transactions in a spreadsheet (a sheet for each month, sheets for the year, monthly cashflow, taxes, etc.; everything from each month filters to where it belongs in the rest). Now I’m trying to decide whether to to switch to one of these programs, rather than depending on my familiar spreadsheet system which takes a lot of time…and I’m behind right now from being quite sick the last few months (think: large stacks of paper on desk needing to be filed/receipts needing to be entered into spreadsheet).

i played around with neobudget years ago, so it’s actually good to see they’re still around.

however, i haven’t used them recently.

personally, i think the envelope system (whether you use physical envelopes or digital) is the best budgeting method. it forces you to keep track of every dollar and move money around when envelopes get “overdrafted.”

and that’s impressive you’ve maintained spreadsheets for a decade! i bet you’ll find that process a lot smoother and faster using a budget-specific tool like YNAB or neobudget.

obviously i’m biased towards YNAB, but if you feel neobudget’s interface is cleaner (and an important “feature” for you) then give it a shot first.

Honestly I am also considering Mint too, b/c it is more a budget/spending tracking, which seems like it might be more what I’ve been doing and take a lot less time? Not sure.

One issue re using anything like YNAB, or whichever, is I buy amazon GC’s at Kroger (gives me points toward gas). Sometimes I buy them with cash I’ve been saving; other times they’re part of a receipt with other groceries (that never looks pretty in my bank account online). Those GCs are then added to my amazon acct to cover monthly subscription items (supplements, for example). So I’m not even sure how that would work w/any online budgeting software.

As I said, I know very little about using a software system other than for tracking (I used to use MS Money a very long time ago–before my ever evolving spreadsheets). It’s a little overwhelming even thinking about switching to something else, so I’m trying to udnerstand the pros and cons of doing so too..

with GC’s and ATM cash withdrawals, what i’ll typically do is put the purchase or withdrawal into whatever category i plan to use the money for.

for example, if you buy an amazon GC from kroger, i would categorize that under “supplements” or whatever bucket that purchase would typically come from.

if it’s multiple categories, i’d split that transaction across those categories.

i do the same with cash. i’ll withdraw the cash from an ATM and categorize it where i plan to spend the cash.

if i’m off or end up using the money differently, i move the unused money from one category to the used category.

i will say if all you care about is tracking expenses and knowing how much you’re spending where, then something like mint may be fine.

but if you actually intend to budget (track every dollar and move money around to compensate for category overspending) then mint is not the right tool, imho.

that’s where something like YNAB is a much better fit.

Thanks, Alex, that was helpful. I am going to start doing the YNAB workshops and get a better understanding of the budget side of things. I guess what I’ve really done for years is micro-mng my expense tracking (though I considered it a budget b/c it did let me know how much I needed on avg in upcoming months). A friend helped me create a cashflow sheet in my spreadsheet a couple years ago, but other than the pretty pie chart letting me know the category percentages as far as my spending was concerned I never understood what else to do with it or how to make use of it.

My plan is to start the YNAB free trial on June 1 (my bank statement cuts on May 31). I’ll prob still micro-mng it b/c my income is limited and it’s habit, but perhaps the workshops will help me get better re that. My pastor looked dazed and confused when he saw my “budget” (expense tracking) spreadsheet with it’s numerous categories and sub categories. It was funny, and not.

Alex

I have just started to use Everydollar and am somewhat frustrated with the lack of any real reporting or downloading of the data into something like a csv or even doc file to use for Budget Committee meetings. Does YNAB have any reporting other than printing the web page?

yeah, YNAB has a handful of reports. you can see the options here:

http://docs.youneedabudget.com/category/134-reports

Mint.com is the best when it comes to reporting (and it’s free). Unfortunately it’s not quite as good at tracking your budget, so it depends on your needs…

Hi Alex,

I use EDP, I’m fine paying for it and working with it’s quirks bc I like the easy interface.

Do you have a post to elaborate more on the end of the month balancing of the budget and moving into a new month (regardless of the platform…)

That’s a step that I haven’t been too clear on how to do…

my process looks like this for balancing/reconciling at the end of the month:

1. going to each bank connected to your budgeting app (everydollar, ynab, etc.) and make sure every transaction recorded by your bank is in your budgeting app. since you have EDP this shouldn’t be an issue unless your bank isn’t one of the supported ones.

2. looking at budget categories i overspent and taking money from surplus categories to compensate. for example, if i overspend on eating out by $15 but have $15 extra dollars in my groceries category, i’ll move that money over.

3. at this point, i can be confident my budget numbers are accurate and can then move into the next month.

hopefully that helps. if not, let me know where you need more detail!

Can YNAB split a transaction across multiple expenses. I shop at Target and Walmart a lot and as such 1 transaction may be for a shirt, dog food, a Blu-Ray, and a mop. I would want this transaction then split across clothing, pet supplies, entertainment, and cleaning supplies budgets.

yup, YNAB supports split transactions. i use them all the time!

My frustration of trying to go from YNAB4 to nYNAB revolves around handling of credit cards (worked through it during trial), loss of ability to go see multiple months for budgeting, and inability to place projected income into future months in order to do strategic forecasting. Focusing on budget month to month is good short term tactical planning but is a killer for strategic planning. YNAB4 allowed both.

Every Dollar was even more frustrating and I gave up after a month as I have nYNAB. Hope YNAB stops trying to force a single way of budgeting on its users instead of allowing them to use the tool in innovative ways.

YNAB does let you budget future months. you don’t have a view where you can see three months at a time (like YNAB 4), but you can skip forward to future months and budget money there.

not sure if it’s implemented in a way that mirrors YNAB 4 since i never future forecasted things but worth checking YNAB out again if this feature wasn’t available when you last checked.

The new YNAB will allow one to budged categories in advance but not income. THat makes forecasting almost impossible as one could do in YNAB4 and before. I have found a workaround, not Clean but it works,

What is the workaround you’re using?

The problem with both EveryDollar and YNAB is that the categorizing happens after you’ve already purchased! Envudu allows you to categorize your transactions before they happen! http://www.envudu.com

for me, i add the transaction immediately after it happens. so being able to categorize a transaction before a purchase isn’t a value add to me. plus having to switch bank accounts to envudu is a deal breaker.

however, props to you and your team for providing another budgeting tool that will hopefully attract a specific type of user.

Hey Alex, thanks for the quick response! We’re actually days away from launching Envudu Connect, that allows users to keep their existing bank account, and have their transactions automatically added to Envudu. No manual entry!

Most apps allow you to create rules that automatically categorize transactions. I know both Mint and YNAB do. Neither of them were perfect as you can only map a merchant/store to a category, but for me using the merchant and the transaction amount would be best.

When would this be helpful? Example, I subscribe to Apple Music and Apple Cloud storage. Both are billed by Apple, but one is 9.99/month is categorized as Entertainment expense, while the other is 2.99/month and is categorized as Cloud Storage category.

It would be easy to create a rule to categorize these if I could use merchant, vendor, and even date fields in the rule.

since your apple bills are recurring, have you considered using scheduled transactions in YNAB? that would allow both to be entered automatically in the right categories even though they have the same payee.

I wholeheartedly agree with your complaint about reconciling at the end of the year. Since EveryDollar is new I am hopeful that updates are forthcoming that will work out some of the kinks. YNAB sounds awesome but I’m just not willing to pay for a budgeting tool.

i was hoping the same thing. but at this stage, i think everydollar is two years old and has made _minimal_ updates since i tested them out when they first launched. that doesn’t give me confidence in their ability to evolve the product any more than where it is now.

and i get the hesitation of paying for YNAB, but it truly is worth it. for $5/month you get the ferrari of budgeting apps. imho, it’s worth finding an extra $5/month to have that type of tool.

I’ve used a spreadsheet to budget for years. I’ve started listening to Dave Ramsey, so I tried out EveryDollar. I had a big shock. Since EveryDollar requires you to do a $0 budget, I found out I was $160 over every month! No wonder I couldn’t keep any money in my savings account!

I owe EveryDollar for this revelation, but I find myself pulling my hair out at other times with the tool. Why can’t I organize my bills by date? This is so incredibly basic. Am I just missing the feature in EveryDollar? I didn’t find transactions within the app until I’d been using it for over a week, so maybe I’m missing this feature too. It’s a dealbreaker for me. If I can’t see how my bills layout timeline-wise, then I won’t continue to use EveryDollar.

Look like YNAB does that, so I’ll give it a try.

nope, it’s not you, it’s them. ;)

thankful everydollar gave you that revelation, but imho YNAB will take you to the next level of budgeting. give it a shot and holler if you have any questions!

I’ve been using Everydollar since October 2015. Since then, I’ve paid off about $7,000 in family debts (car and student loans) and have saved about $8,000 for a rainy day fund. (Along with twin boys having surgeries each year.) Everydollar makes it easy to track and focus your expenses. I’ve done most of it with the free version, tracking transactions manually. But, I’m planning to get the plus version because they do such a great job making tracking expenses so easy in both the mobile and desktop apps. I’ve been trying YNAB—I really wanted it to work—and have tried Mint. They’re just not as easy to do the simple tracking I’m looking for, even though they may offer more advanced features.

nice! way to pay down that debt and save a bunch! if everydollar works for you then by all means keep with it. the best tool is the one that works for you.

Can you set up your own custom account categories in YNAB? The inability of Mint to allow this critical feature (at least for me) was a deal breaker.

yup. you can totally create your own categories. i swapped most of YNAB’s default categories with my own.

Hi Alex! I am new to all of this, but am looking for a program that allows for being paid twice a month, and different bills to go out for each paycheck. Is that possible with YNAB?

yup! that’s totally doable in YNAB. when you get a paycheck, enter it into YNAB. you then allot the amount of that paycheck to whatever bills are upcoming. repeat for the next paycheck!

That sounds promising! I’ve looked at all the starter videos, and I’m in still tears. I’ve been playing with Mint and Mvelopes and EveryDollar and I stink at all of it. Is there a YNAB for dummies video? :

There are lots of video tutorials on YNAB’s site. Also, their customer service is phenomenal! I’ve never had to wait more than an hour or two for an email response. Well worth every penny IMO. I tried using Mint too and it doesn’t even compare.

I get paid twice a month and so does my husband. I do what you are asking for all the time with YNAB.

Thanks Alex! You hit the points I was most interested in. I’m deciding what to move on to after I get tired of being a Luddite with YNAB 4.,

haha. luddite. ;)

Thank you so much for updating this post!! I’ve been watching this post for 6 months, always trying to decide if YNAB is really worth the time and money that I put into it. I recently went through the Dave Ramsey classes & thought maybe it was time to just try EveryDollar. I’m glad someone did it for me (someone who understands budgeting software a lot more than me, too). Thank you again for staying current and being so thorough! :)

i really do believe YNAB is worth the time/money!

while i’m very pro Dave Ramsey’s classes/teachings (i just went through FPU this fall), EveryDollar is just not even in the same league as YNAB.

i appreciate the comment. and please let me know if you have any questions getting started with YNAB. i’d be more than happy to help. use the contact page on this site to holler at me!

I found Everydollar to be very easy to use. For me, that was key.

I just started setting up my YNAB and it is a little intimidating. AND do I have to enter each transaction as it happens? I was hoping it would import them directly.

nope, you don’t have to enter transactions as they happen. i just consider that a habit to keep up on. that way you know your budget is always up-to-date.

if you wait for the import to happen, you budget numbers could be off since there’s a 2-3 day delay from a transaction happening to when it can be imported.

but if you want to just rely on the import and not enter any transactions, you can!

what’s the part that’s intimidating you the most as you get started with YNAB?

Hey Alex,

I’d be interested in hearing your thoughts after trying both applications during Dec of 2016. I’m looking to implement one of the two here in the next couple weeks.

i just updated this review to reflect the latest versions of YNAB and EveryDollar! in short, my conclusion hasn’t changed.

i still recommend YNAB and would never recommend EveryDollar to anyone. and i’m also surprised at how little EveryDollar has changed within the last two years.

I’m a long time Mint user. There are 3 key / must have features you didn’t address. In fact, I’d argue it’s not a budgeting software at all without both 1 and 2. While, #3 is more specific to me. Do you know anything about the following?

1. The ability to sync to your CC account.

Can we have YNAB or EveryDollar automatically download our CC transactions (WITHOUT logging into a CC account and downloading a file manually)? I know it does this with bank accounts, but CC?

2. Automatic assignment of re-occurring transactions. For example: Every month I pay Christian MediShare my premium. I don’t want to have to manually assign the merchant “MediShare” to the same budget line item manually every month. Whether it came from my checking account or cc, I’d like it to automatically assign and I’d like the option of to be based on both dollar amount and/or merchant.

3. Syncing with zillow and automatic mortgage statement download / equity update. This is a very important feature to us as we have multiple rental properties in multiple states. Monitoring their value monthly and what the local market is doing as well as having it automatically download the latest mortgage statements and showing the equity gains etc, is one of the few things mint does very well. If this is manual in YNAB or EveryDollar, the amount of time it would take to do this for say 4 rental properties = hours a month vs. zero seconds in Mint.

Correction – maybe you addressed #2 – I guess I’m just looking for clarification, is it automatic based on merchant and/or dollar amount? Or, is it a manual scheduling of a payment amount only?

heya jim. great to have a mint user chime in. to answer your questions…

1. the new YNAB supports automatic importing of bank account transactions (similar to mint). this review is currently for YNAB 4 which does not support that feature. i’ll be updating this review in january to compare the latest versions of YNAB and EveryDollar.

2. YNAB does support scheduled transactions so that every month on the same day it gets auto-entered into your register with the name, amount, and category pre-filled for you. i use this feature often and it’s a must have! (something EveryDollar surprisingly still doesn’t support.)

3. the new YNAB will import mortgage information from supported banks. i’m pretty sure YNAB uses the same bank import service as mint, so if it’s supported in mint, YNAB will also support it.

as for zillow estimates, i haven’t seen support for that in YNAB.

however, i prefer to use YNAB solely for budgeting. for tracking net worth and investments, i prefer personal capital. they support zillow estimates and are much better for that task, imho.

1 yes and 2 yes… 3 I don’t think so

Jim, I am a long time user of EveryDollar and MTMMO (myTotalMoneyMakeOver – ED’s precursor) software before that.

EveryDollar (Plus) definitely gives you the ability to sync credit cards and bank cards/checking accounts and savings accounts.

EveryDollar also WILL automatically assign recurring transactions. It does this by (optionally) creating each monthly budget based on your previous month’s budget. In other words, when I create my new budget for May, it will take all of my categories and budgeted amounts for April, and copy them into May’s budget. From there I just tweak the amounts if need be. I never have to touch items that are a set amount, like my internet provider bill.

That being said, I have been having connectivity issue with my credit card account in the last few months. On two or three occasions, ED has stopped pulling in my CC account transactions for a week or more. It’s enough of an issue that I am looking for other solutions. I have EDPlus for free, because I was an early user of MTMMO and they grandfathered me in for 3 free years of ED Plus. I really love how dead easy ED is , but those three free years will expire next march. Was hoping to ride it out until March, thinking surely they will fix, but it has been several months now (and yes, they have been made aware of situation more than once) and no fix so far…

Thinking I will try out YNAB…

YNAB also has periodic connectivity issues, however, it’s never been as bad as you’ve described. they do have a handy status site that lets you know if there’s a larger problem with specific banks.

http://status.youneedabudget.com/

also, i’m pretty sure both YNAB and ED use a third-party service called finicity to connect to bank accounts. finicity pretty much has a monopoly on that. so some of the issues you’re facing with ED may also be present with YNAB.

Thanks for the actual how to videos. I thought ynab can sync with bank accounts.

the most current version of YNAB can import transactions from bank accounts. this review is for YNAB 4 which does not have that feature. however, i plan on updating this review soon so that it talks about the new YNAB instead of YNAB 4.

Hi Alex,

Currently we don’t know what we owe or what we have in savings or retirement. Not a good scenario. I am taking charge to change the situation: My goals are: 1. knowledge of our accounts

2. Paying credit card debt (not much) 3.Start saving for emergency fund and house down payment and eventually kids education and our retirement.

I was hoping the YNAB will help with our goals. My question will there be enough guidance on how to save in YNAB or it is available in Dave Ramsey program. His talks seems too storng for my personal taste. What do u recommend? Thanks for the response.

the new YNAB will absolutely help with all three of your goals. i would _strongly_ recommend you give it a try first.

i just went through dave ramsey’s financial peace university through church, and i can see where he does come across too strong. his baby steps are solid and worth following. while i don’t 100% agree with dave on everything, i am following the baby steps in order.

however, everydollar (the tool he created) is not very good for what your goals are.

pay for the new YNAB ($5/month) and spend the time learning how to use it effectively. it’d be worth signing up for a free class even.

i promise you, if you take the time to learn YNAB, it’ll be worth it. you will have such a better grasp of your financial situation.

and if you ever get stuck, don’t hesitate to ask YNAB support or the forums (you have to create an account first).

YNAB is now $50 PER YEAR! Even for those who have an active account, there is a YEARLY fee of $45. Does that change your practice or your analysis?

yeah, i was kinda bummed when i heard the transition to a subscription model. however, i don’t blame them for doing so (because i get the need for sustainable, recurring revenue).

as to your question. similar to what i did with YNAB and EveryDollar, i’ve been using YNAB Classic (one-time purchase) and YNAB (subscription based) side-by-side this month to compare. i’m going to give it a few more weeks before i draw any conclusions. but here are my initial impressions: it’ll be fine for first time YNAB users. existing users will find a harder time transitioning (namely due to missing “features” and a slight change in methodology).

i will say even with the subscription model, YNAB is totally worth the cost. you won’t find a better budgeting tool. it’s easy to justify $50/year when you consider YNAB will easily help you save more than that each year.

I look forward to your review of the New yNAB as I am a YNAB 4 user and have been “struggling” a great deal with the new version. Anyone who reads the forums on YNAB can quickly see that there is a lot of displeasure in the new version and that the die-hards will be using YNAB4 until and after the support ends for the new version in Dec. 2016. I have spent a lot of time maintaining both YNAB4 and the new version and what I have concluded is that even more precious than “stewardship”/budgeting is on what we spend our time. With as much time as I spent, reconciling accounts, learning YNAB, finding workarounds and otherwise trying to get this software, any software to behave, I could have just used that time to make money doing anything, absolutely anything else.

As much as I love having everything on my computer, or on a web app, I would prefer to just get the hours back by adhering to a budget, carrying and paying cash, and being “happier”! Having everything on paper, a sheet of paper, a simple Excel spreadsheet is my goal for this month. It seems to be that the YNAB community is peculiar and a bit narrowminded in that regard where spending hours each week, more hours than one should, on something that just isn’t working for them. It’s exhausting simply to troubleshoot! The millionaires I know, have never had a Financial Planner or ever used a computer, believe it or not. Slow and steady wins the race. ;-) As a business owner, blogger and author, in a cost-benefit analysis, I haven’t found any software that has made my life better and given me more time.

Thanks for sharing Michelle. With YNAB4, did you ever get a working system in place? One that didn’t require a lot of thinking or troubleshooting?

If not, what’s been your main challenge getting a working system with YNAB?

I’ve been able to get to that point with YNAB4. It runs on autopilot with less than 30 minutes spent each month (distributed across the month).

That familiarity is making me learn towards using YNAB4 for as long as possible. Or at least until the new YNAB evolves a bit more.

I completely agree. YNAB 4 just shines more and more that I use it. I use it for my budget and my father’s as well and in three short months, it has both helped us get current with expenses and get out of debt. Yes, I do believe I have a working system in place for YNAB 4, the Budget is on point and the account registers are very helpful. They do help you to see from week to week what your running balance may be helping you to be more or less conservative depending upon what is in the account at the time. Yes, I know that they say that you should have one month’s income “extra” in your checking account, but there’s no way I’m going to put $16,000 in a non-interest bearing account.

My main challenge USED to be entirely my own fault. You see, before I would use my debit for everything and then manually input the transactions and it would just take hours a week of just that because for some reason the download from the bank would not really work so well. Now, it’s easy. I’ve set up Scheduled Transactions for the main things and Cash Out what I need once for the month. I’ve paid off some debts and brought my utilities current (the summer months are so expensive with the AC and take ages to pay back), so now my budget has settled down into the essentials.

I do have a few criticisms of YNAB4, but they are eclipsed, non-issues after working with nYNAB. I enjoying the running balance feature, the three-month view which allows for planning (how does one plan in nYNAB?), etc. The biggest plus, printing out the budgets. Not everyone is hyper-teched up! I use technology so much in my business and in life that I love to just sit down with pen and paper and interact with the page. I’m a former English grad student, so books, pen, paper are my go-to comfort zone. I’ve got a business, so yes, technology social media seem to dictate there as well. Thanks and God bless!!!